An Introduction to Japanese Candlesticks Course

Looking for live Candlestick Patterns click to view latest patterns

Chapter 1: Introduction

The key to successful trading is knowledge

Trading systems that can generate only profitable trades do not exist. A trader's decisions are often

made

as a result of personal experiences, their feelings, their judgement and their ability to assimilate

the massive flow of information to which they are subjected in the modern trading environment.

(Fundamental data release, news events, and major technical levels etc.).

Technical Analysis is an invaluable decision support tool available to traders. Candle Charts are one

of the

most unique and precise methods of all the known pattern recognition techniques (Understanding

Candlestick Charts should be a must for any trader).

Candlestick charts give a somewhat unique insight into global market sentiment. They give the analyst

the ability to interpret individual segments of price action.

As I have already said, a trading system does not exist that yields only profitable trades, this is

because the system would have to react with extreme flexibility to deal with all the factors driving

market

volatility.

For the time being analysts use tried and tested techniques to forecast future price fluctuations

both for trading and strategic purposes.

Candlestick charting is probably one of the oldest forms of technical analysis (dating back to the mid

16th century)

The Japanese Candlestick is currently enjoying somewhat of a resurgence, as traders begin to discover

the simplicity of this method, which was first used over four centuries ago.

What the Candle Chart will do for you!

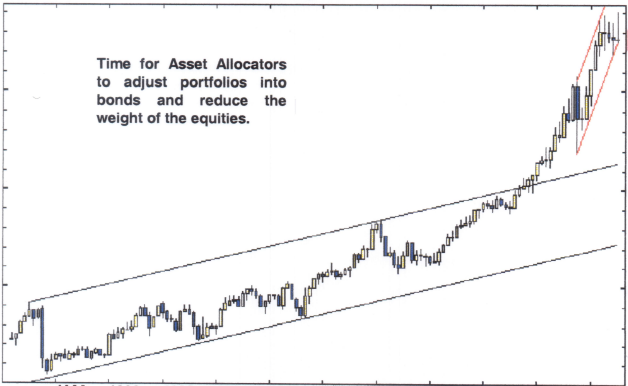

It will help you understand timing, trends, and market reversals. Also will help you build discipline in taking profits and setting a stop loss.

The History

By the early 15th century the Shogun Tokugawa managed to pacify the sixty daimyo feudal lords to

create a unified country. This allowed more freedom of trade between the provinces as well as towns such

as

Edo and Osaka. (Osaka was to become the centre of this trading activity). Even today the traditional

greeting in Osaka is "Mokarimakka", which translated means "are you making a profit.

Early records show that charts where first used in Japan in the early 16th Century. This technique was

first used to record the price fluctuations in the rice exchanges of feudaIJapan. Rice was essential to

the

Japanese economy and was used as a unit of exchange as wellas being the primary dietary staple of the

Japanese people.

There were as many as 1300 rice traders working in Osaka at the Dojima Rice exchange. As trade

developed, receipts from rice warehouses were accepted as payment and hence the first futures contracts

were effectively traded.

Sokyu Honma (1716 - 1803) was a brilliant rice merchant who is widely acknowledged as being the

grandf ather of Candlestick Charting.

Honma was such a successful trader that he was eventually elevated to the status of bushi or samurai

which was practically unheard of in his day (merchants were regarded as being very low on the social

ladder). Honma developed a series of rules which were called the "Soba samni no den" or the Sakata

constitution.

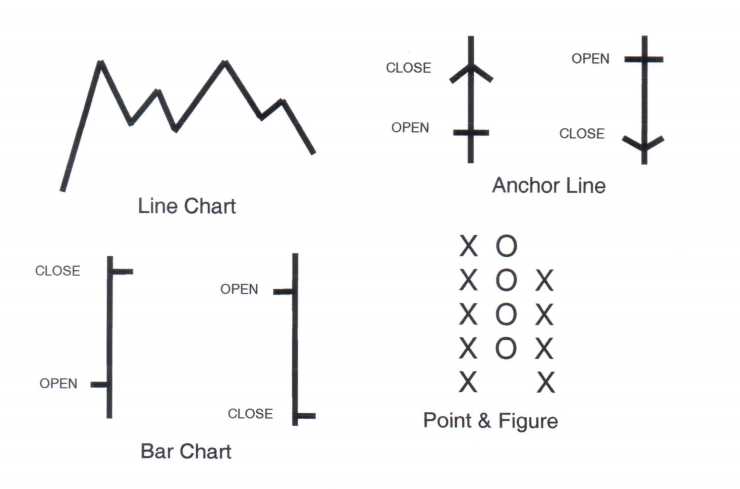

The Different Charts To Be Aware Of

A Candle Stick Chart

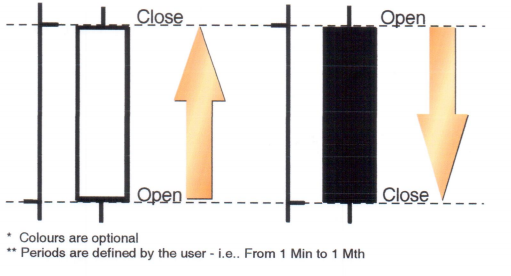

What is a Candlestick?

A Candlestick is a graphical

representation of the High,

Low, Open and Close

therefore is identical to the

more common bar chart

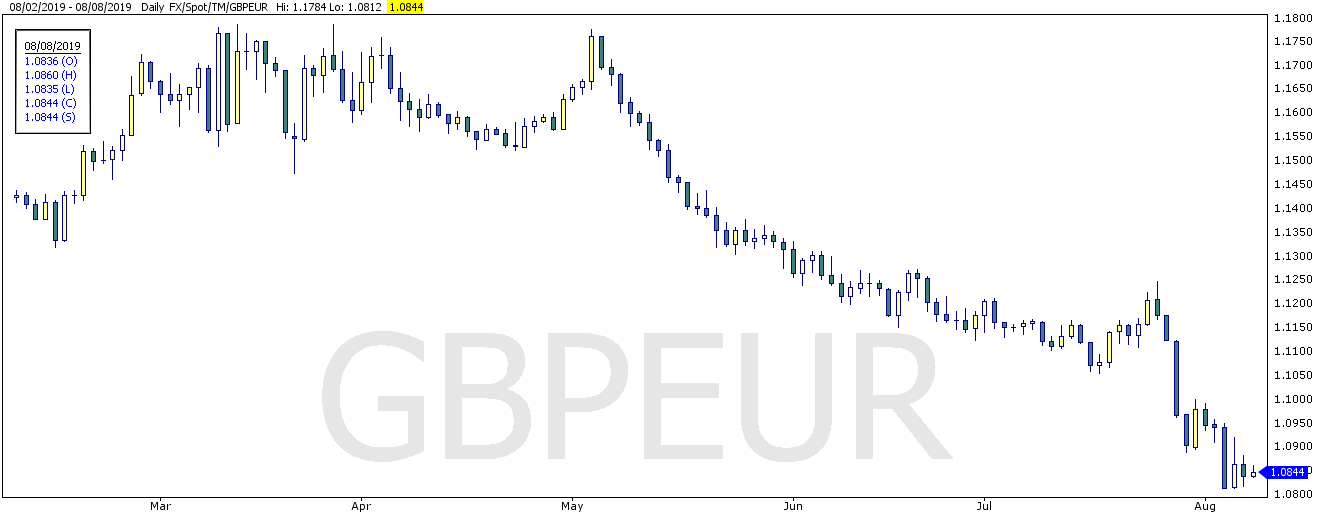

The Candles are colour coded, a light 'candle represents a higher closing relative to the opening of the

particular

session period". A down candle is generally darker, i.e. when the session closes lower than the opening

price for that

period it will become a redo candle.

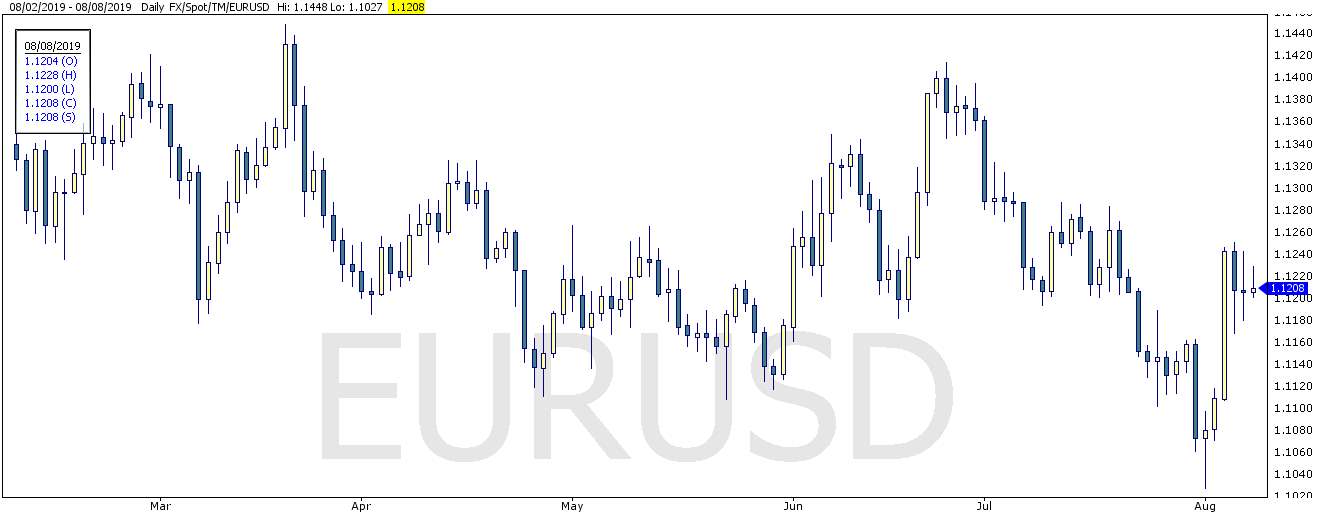

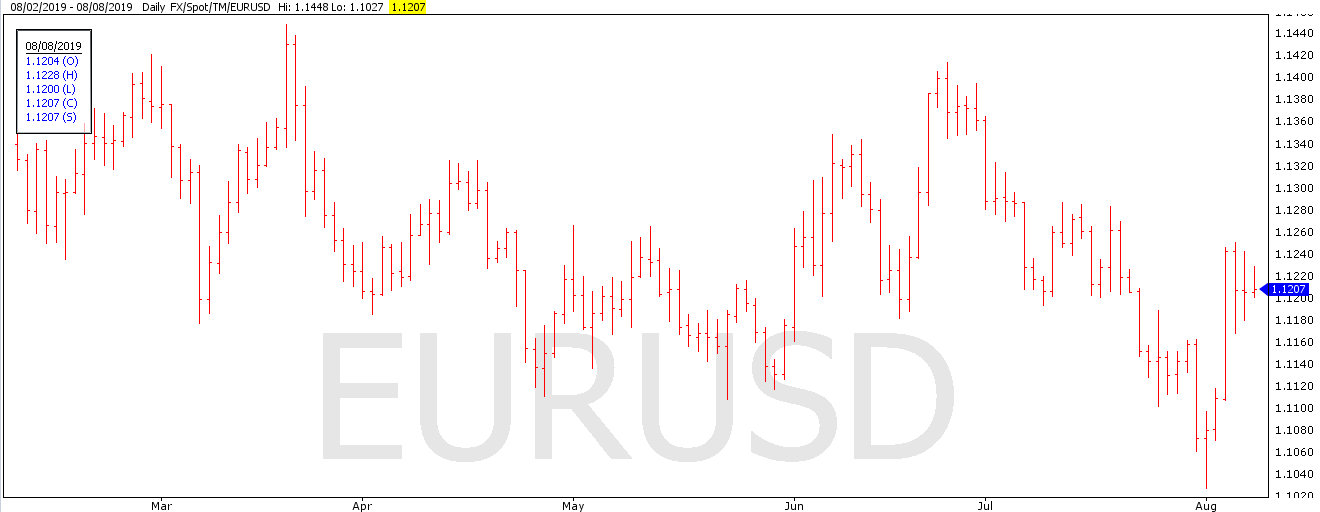

The Candle Chart Vs. Bar Chart

Candlestick Chart

Even though the bar and candle chart are graphical representations of the same inf ormation they

completely different.

Bar Chart

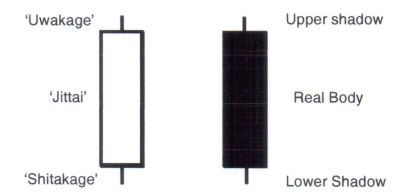

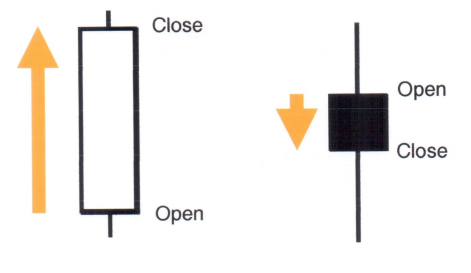

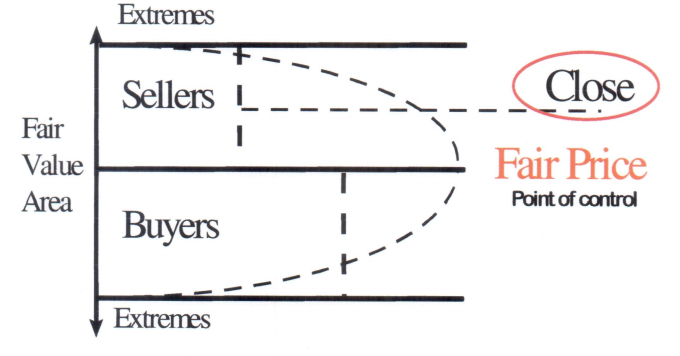

"Jittai" - The Real-Body

The size of the real-body can give us important clues to market sentiment. The Real-Body is the area

between the open and the close of the candle

This is the area where most of the trading activity occurred and theref ore it sometimes known as

the true value area. (This is not unlike Steidelmeyer's theory of Market Profile© where it is

important to establish the point of control of the market to determine price equilibrium)

The closing price is the single most important piece of information that you have at your disposal: it is

the

price that will indicate the direction of the next session opening. Most technical indicators will use

the

closing price as a basis for the calculation of buy/sell signals. Important signals willbe generated on this

one

piece of information alone. Corrective and reversal points (see classification)

The colour of the real-body can quickly underline the directional changes in any given market over any

given time frame.

The impact of opening versus previous closing.

"Uwakage - Shitakage " Shadows

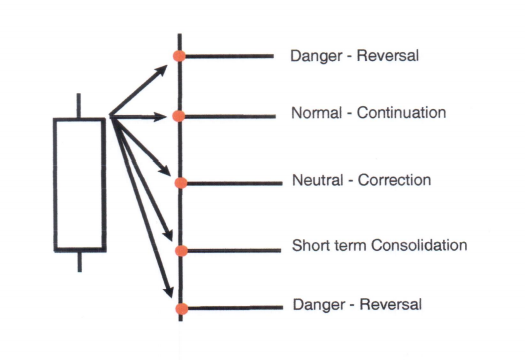

The 50% Level Market Profile

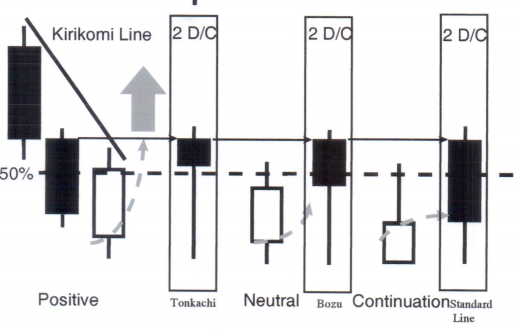

To understand the importance of the 50% level is necessary to understand the concept of Fair Price and

Market Profile e. For any given distribution there will be a level, which is accepted by the market, i.e.

an

equilibrium level called the Fair Price. A close above the Fair Value area is a useful hint.

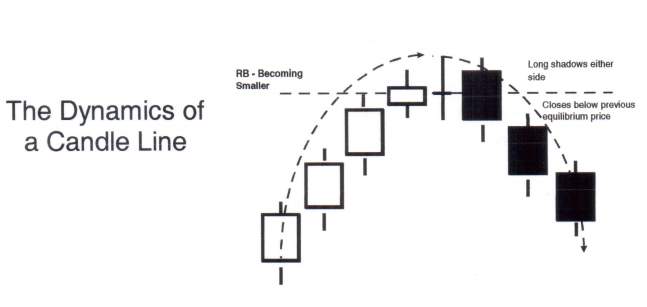

A nomlalcandle is called a strong line, this simply means that it is a positive continuation of either a

bullish

or bearish move.

The smaller the real-body the weaker the candle, typically this is when the market consolidates and

uncertainty exists in the market with traders squaring positions and looking for a potential reversal or

corrections

Lengthening shadows herald the existence of weakness in a trend

Significant penetration into the previous line is a potential reversal sign once confirmation has occurred

Chapter 2: The Classification

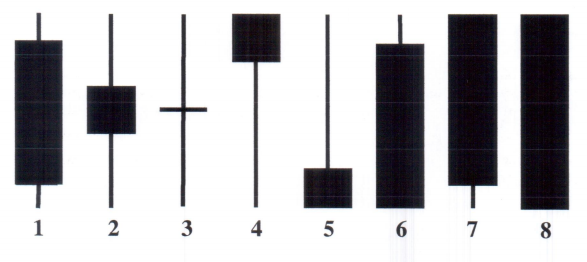

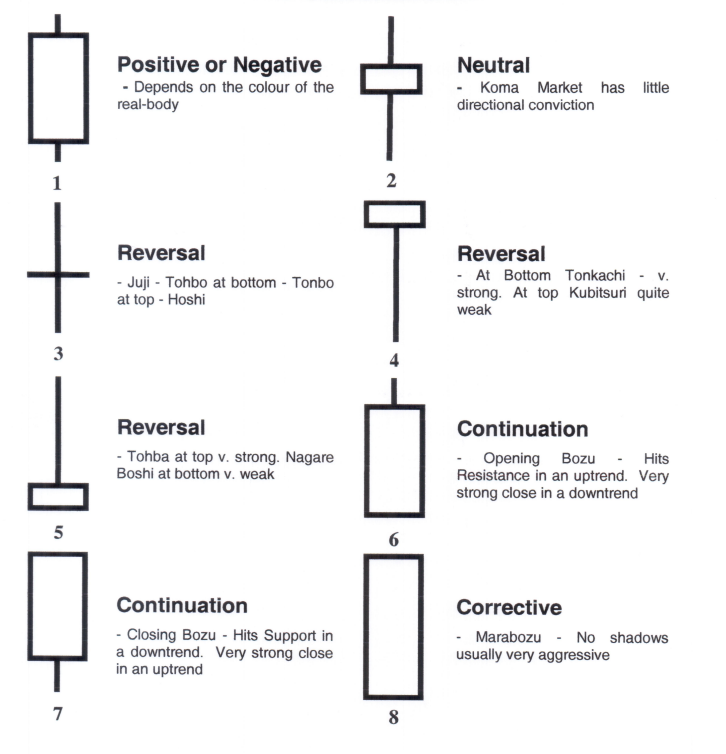

The Original Eight

A New Perspective

A market can only form one of eight candles during each specific time period.

Interpretations may vary in different markets but the basis remains the same.

There are no other possibilities.

Once you understand the eight candles, apply them to the markets you are trading.

"This is the key to the technique"

1. The Standard Line

The standard line is generally considered to be a continuation candle. They are recognised by

the strong real-bodies and smalllower and upper shadows. They will not provide you with any

specific clues in terms of a potentialchange in market direction. They indicate that the market's

directionalconviction is good.

The Standard Candle

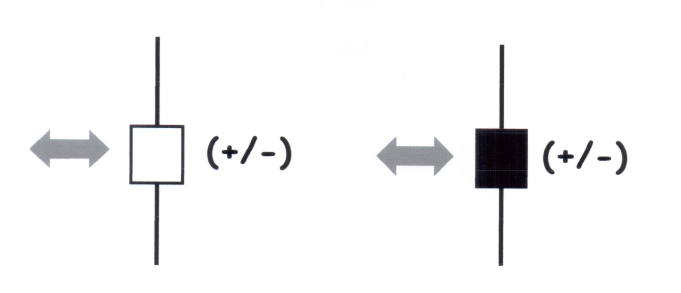

2a The Koma - Spinning Top

The Spinning Top is a neutral pattern and is distinguishable by its small real-body and long upper and

lower shadows.

Generally the market is considered to be consolidating when this pattern is formed. The market has very

little directional conviction

Koma - Spinning Top

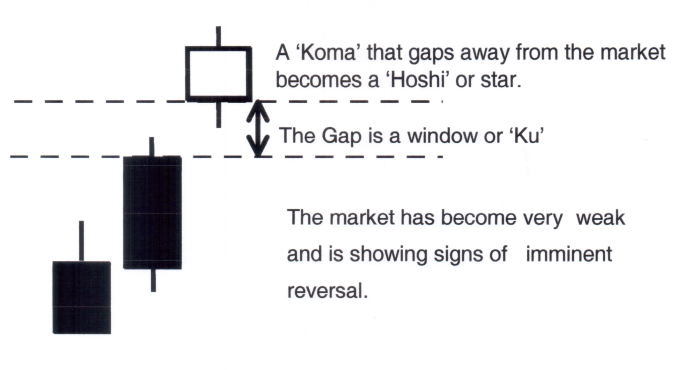

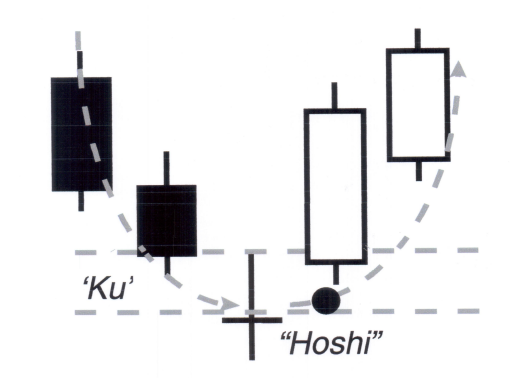

2b The Star - Hoshi

A potential top reversal pattern

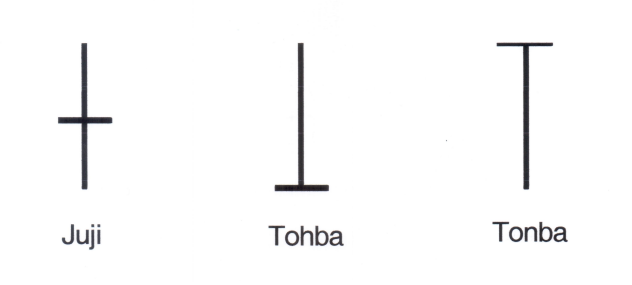

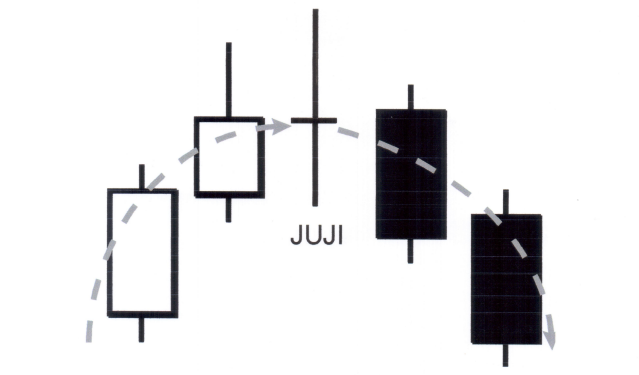

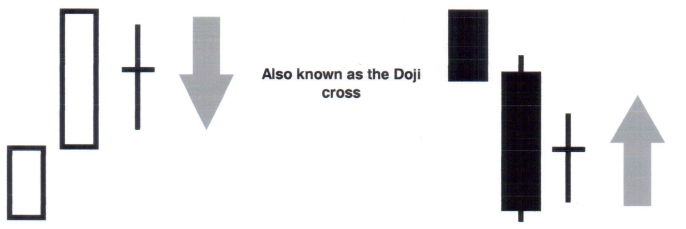

3. The Doji - Reversal

The Doji is very important, it is considered to be a reversal candle. The Dali represents the area where

the Bulls and the Bears meet. (Where the Open and Closing prices are equal, in Japanese Doji means

'the same as'). Originally there were four types of Doji but you will only observe and be affected by the

first three.

A potential top reversal pattern

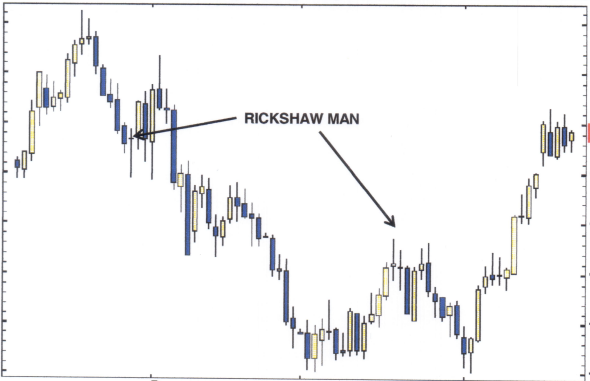

The Long Legged Doji- (also known as the Rickshaw man), shows a potential turning

point where the

upper and lower shadows are long and are of approximately equal length.

Rickshaw Man

3b. The Gravestone Doll- 'Tohba'

It is called the gravestone because of its shape. The original thinking behind this pattern was that this

was a sign of the end of a bullish attack.

Gravestone Doji

3c. The Dragonfly Dojo- 'Tonbo'

This is the exact opposite of the Gravestone and is found exclusively at a market bottom.

Dragonfly Doji

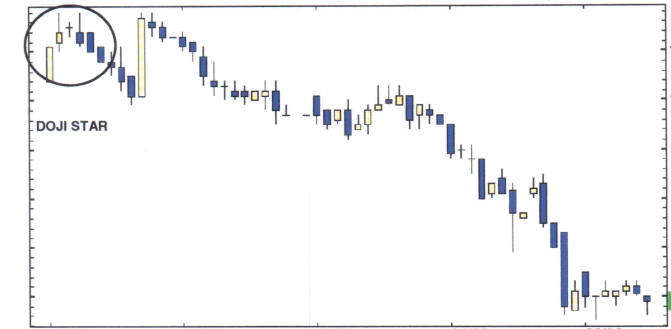

3d The Dojo Star

One of the strongest reversal patterns, found at tops and bottoms. Is known as a pattern of three, though

at this stage the Dojo that gaps away from the previous close is warning enough.

Dojo Star

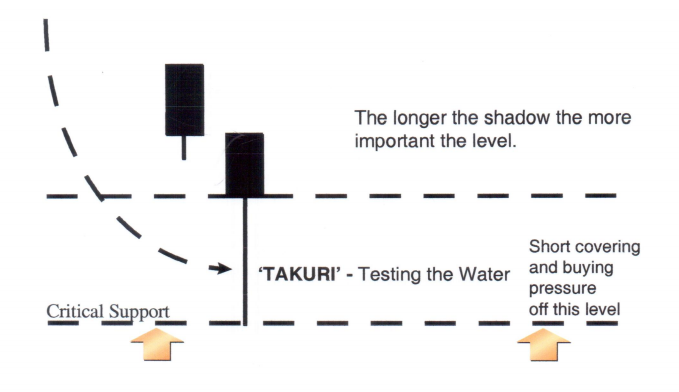

4 The Umbrella - 'Karakasa'

At the top of the market this pattern is called a hanging man, but at the bottom of the market it is

known as

a hammer. There are two distinct variations of the umbrella pattern. The Hanging Man at a market top

and the Hammer at a market bottom. An umbrella should have a small real-body with little or no upper

shadow. The lower shadow should be 2/3 times the length of the real-body. The umbrella is widely

regarded as a reversal line but confirmation of reversal is required. The colour of the real-body is

usually

not considered to be important but would recommend that you do pay attention to the direction of the

closing as this gives additional weight to the pattern.

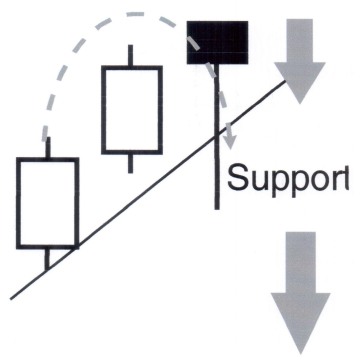

4a Hanging Man

The market has to be in a clearly defined uptrend

The market shows signs of weakness and aggressively tests the downside.

The session however, closes much higher than the recorded low. A close below the support in the next

three periods is required for confirmation if reversal. A break of a trend line could also act as a

valid confirmation.

Hanging Man Exmaple

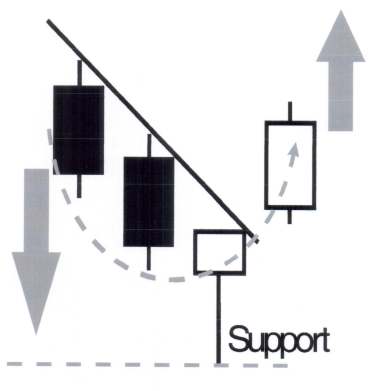

4b The Hammer

The Hammer is a very important

bottom reversal pattern.

The colour of the real-body is less

important than for the Hanging Man as the

market has bounced off a low in a

downtrend.

Strong buying has occurred, and indicates

a good levelof resistance.

The long shadow is indicative of the strong

buying pressure.

Hammer Example

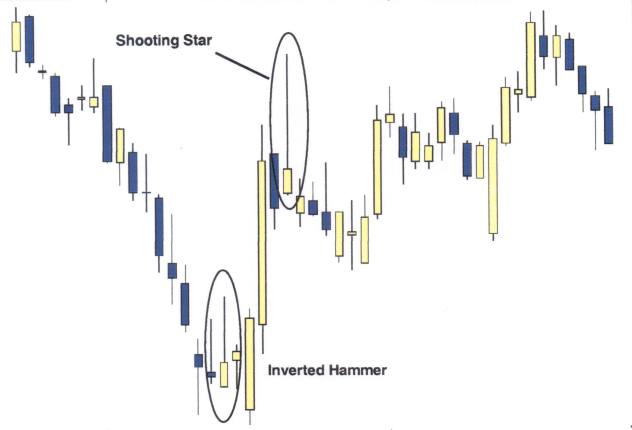

5 Inverted Hammer -Reversal

This pattern is the direct opposite of the umbrella lines or Karakasa. The shooting star can be a

powerful

revenalsignalin an up-trend (but only on a new high). An inverted hammer is indicative of a strong area

of resistance; confirmation is sought prior to entering any new long positions

Inverted Hammer Example

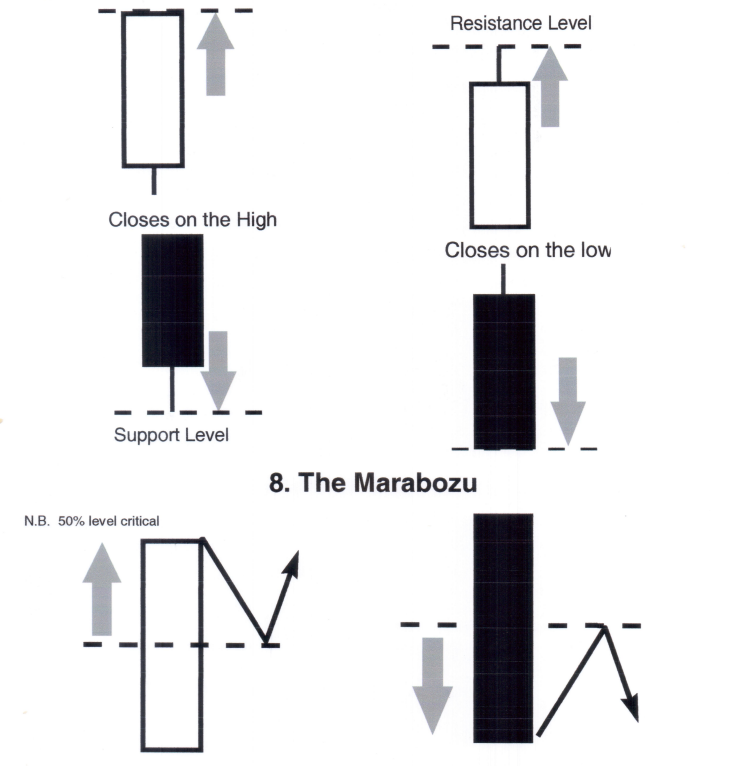

6/7 The Bozu Line

Also known as a Belt Hold Line or Shaven Top or Bottom. These are continuation lines but can show

weakness in a trend.

The Marabozu is a Candlestick with no upper and lower shadow. The period opens and closes on the low

and high. The Marabozu is very common in short term charts, especially after the release of economic

data. It is usually corrective to some degree.

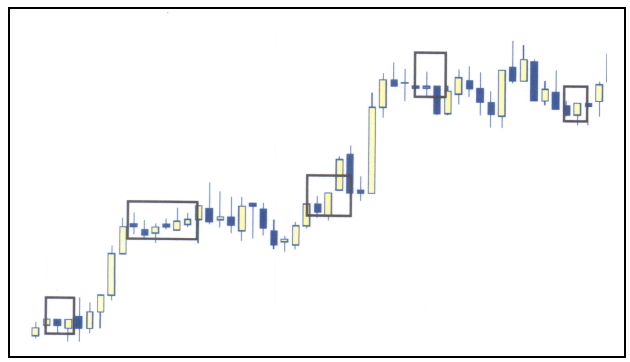

The Long Standard Line

The long standard line is easily identifiable as a single candle line. It is 2/3 times the length of a

normal

standard line (it stands out). Like the Marabozu this line generally corrects and it is quite common to

draw

corrective retracements along the length of the move in order to be able to ascertain the ability of the

trend

to continue in its actual direction and to sustain the momentum of the trend. Because of the abnormal

size of the move a correction or consolidation phase will always occur after this particular line.

The Classification

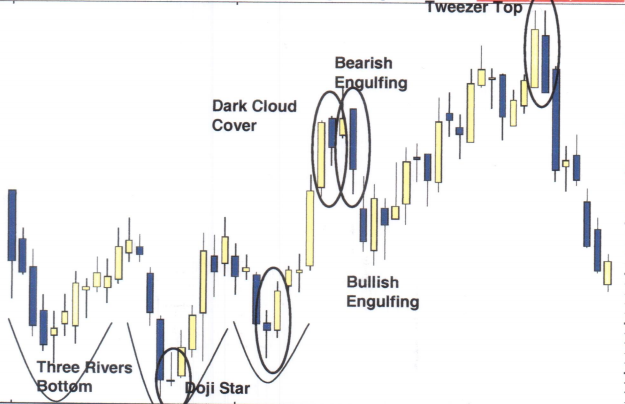

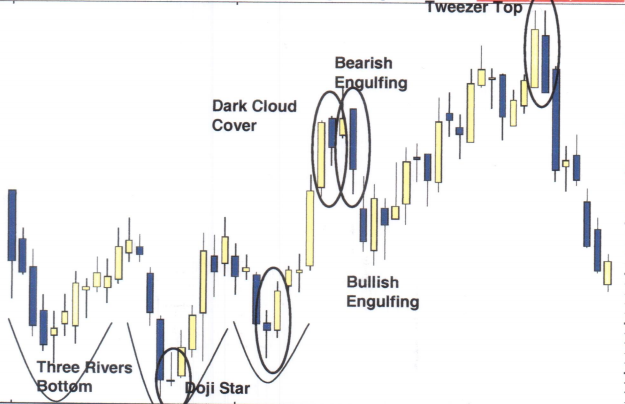

Chapter 3: Reversal Patterns

In section I we looked at the individual classification of the various candle lines and have assigned a

nominalvalue to the moves in terms of positive, negative and neutral. In this section we look at the 2-day

(session) reversal patterns. In this section it is essential to understand the impact of the opening verus

the previous session closing value as this is always a good pointer to the state of the market. We also

look at a little known confirmation technique which is derived from combining the open of the first day and

close of the second day, this information is then used to create an artificial candle, and the classification

of

this is used as a confirmation signal. This is done to achieve a greater understanding of changes in

market sentiment.

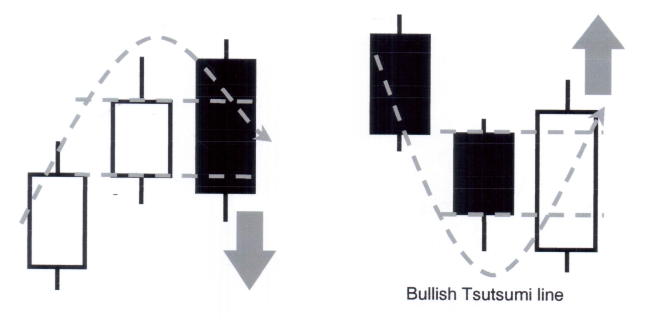

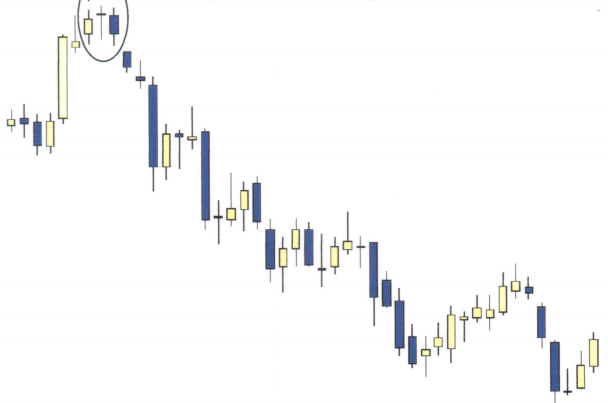

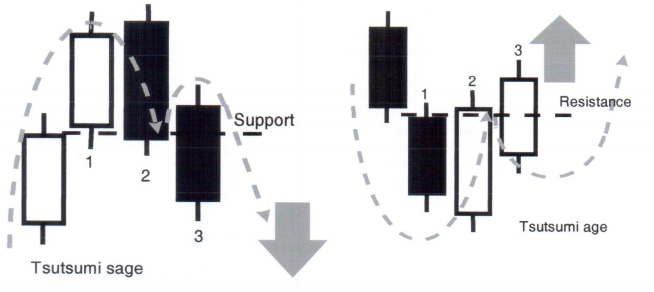

I -The Tsutsumi Line

Bearish Tsutsumi Line

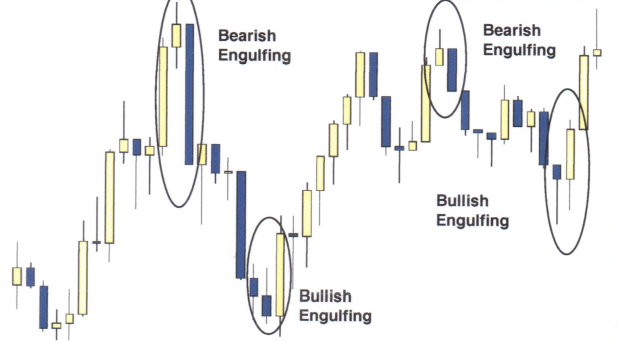

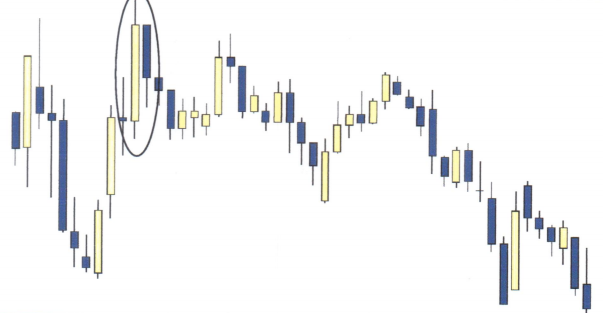

la. The Bearish Engulfing Line

Tsutsumi Line

The Engulfing Line is one of the strongest

of all the reversal patterns and is a quick

and effective method of spotting a

change in market sentiment.

The market has to be in a reasonable

trend for this pattem to be validated.

Tsutsumi Line

The next period opens higher than

the previous close, creating a gap or

'Ku ', (in section 1 we have seen that

this phenomenon is usually a sign of

market weakness).

The real-bodies are obviously of opposite colours.

Tsutsumi Line

The close of the current candle line is lower than the previous session open - engulfing the whole of

the last real body.

The shadows are not taken into consideration at this stage.

Tsutsumi Line

The open of the first day and close of the second day would result in the entire session resembling a

Tohba or Shooting Star.

This technique gives additional understanding to the analyst and suggests that this pattem does not

require confirmation.

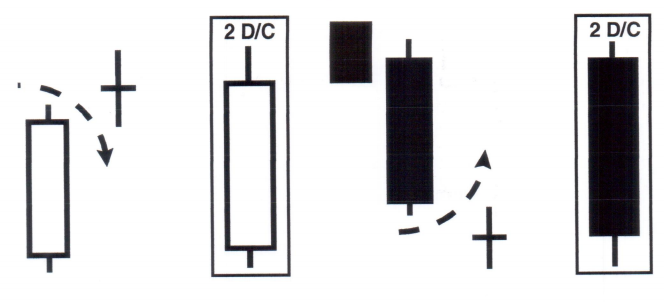

1b The Bullish Engulfing Line

This is the reverse of the bearish engulfing pattem and is very strong with the 2DC forming a

hammer

There must be a reasonable trend in place for this pattern to work.

Trading Strategy is to square trades that are positioned with the prevailing trend and get ready to

reverse if second day f ollows through - (Confirmation is not necessarily required if all the rules

have been adhered to).

(2 Day Candle - Classification = Tonkachi Positive)

Bullish & Bearish Engulfing

2 -The Kabuse Line

Very similar to the Engulfing pattem but does not engulf the whole of the previous 'Jittai '.

A sustained up-trend is required, with price action of the active session opening higher than the

close of the last session and in turn closing well into the previous real-body

The greater the penetration into the previous period the stronger the signal.

Trading Strategy - Close long positions; go short when trend reversal confirmed.

This line is a reversal but is weaker than the engulfing pattem therefore a close below point (a)

would act as a confirmation

2 Day line - Classification

Star = Negative

Kabuse Line Example

3a Deaisen - Counter Attack Lines

Deaisen is a meeting line - in effect two periods of price action converge, to form a reversal

pattern known as the Piecing Line

Sashikomi is when a big gap occurs between the close and the opening of 2 sessions with price action

retuming to close on the higt] meeting the old price action.

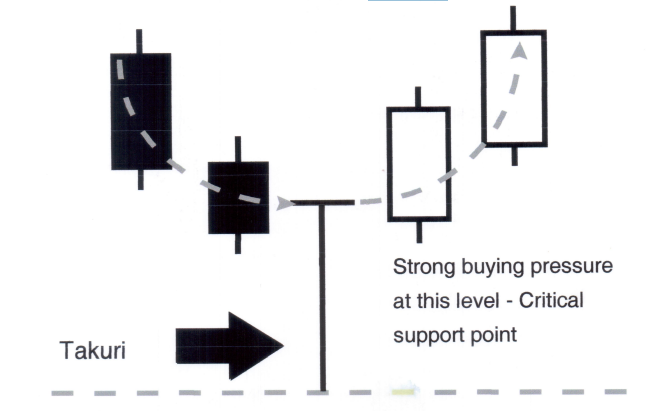

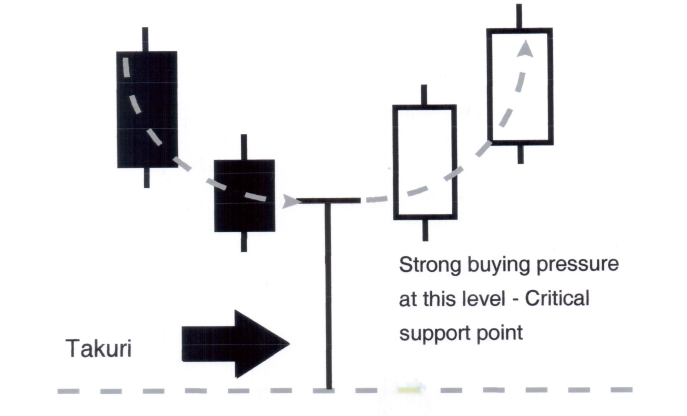

The 2 d/c Shows the long'cTakuri dnd suggests that price action has touched a key support but

confirmation is required prior to reversing a position i.e. a new high in the next trading

session.

Deaisen - Counter Attack Lines Example

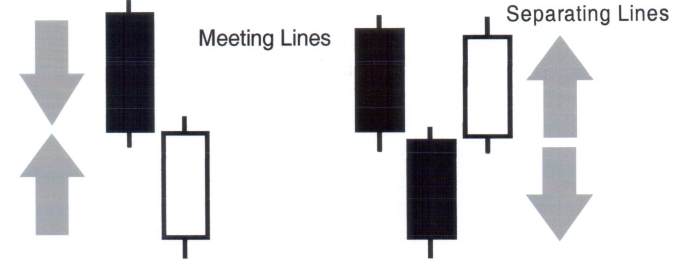

3b Deaisen - Meeting Lines

The Bearish meeting line is found at the top of a trending market.

Price action initially gaps away from the previous close, but closes into the real-body of the

previous session.

Deaisen - Meeting Lines

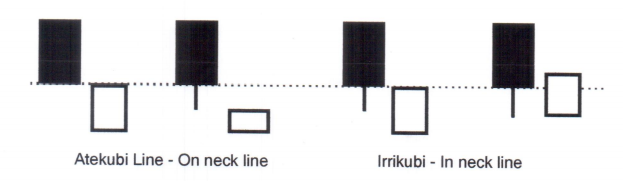

4 The Piercing Pattern

Again similar to the Engulfing pattern but does not engulf the whole of the previous 'Jittai '.

An important feature of this pattern is that you must get significant penetration into the previous real-body

to walla reversal.

The greater the penetration into the previous 50% period the stronger the signal.

Trading Strategy - Close long positionslgo short when trend reversal confimled.

The importance of a close. well into the previous real body is highlighted by the 2 d/c

5 Atekubi & Irrikubi Lines

These patterns are variations of the piecing line. They are by nature weaker. The Atekubi is the weaker

of the two patterns, and is generally found after erratic market moves. Sellers provide strong resistance.

The Irikomi line is usually interpreted as a temporary recovery.

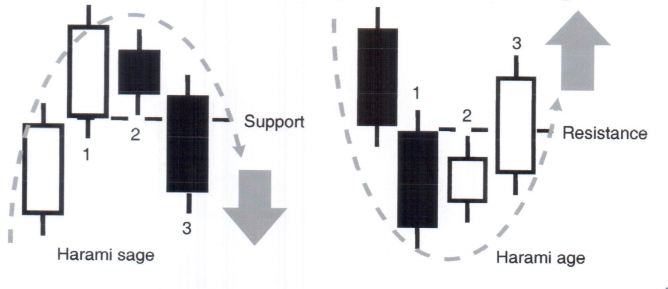

6 The Harami Line

6a The Bearish Harami Line

The Haramiline is also known as an inside day This is because the price action is contained within

the previous period's real-body.

A market must be trending before it can be considered to be a reversal.

The market opens lower than the previous close and becomes corrective as opposed to a reversal

signal.

Very often second line is a 'Koma' or spinning top

6a The Bullish Harami Line

The Harami line does nQ!.m.ake.q new.Hgh so needs tQ be confirmed in the next session if you think

that it'ii= heralding a change in market sentiment.

Trading Strategy - Exercise extreme caution when you see one of these patterns, raise your stop-loss

level if risk to reward ratio is good enough. If expecting a full trend reversal it is imperative to

seek confirmation prior to acting. (This could be a subsequent u/d move).

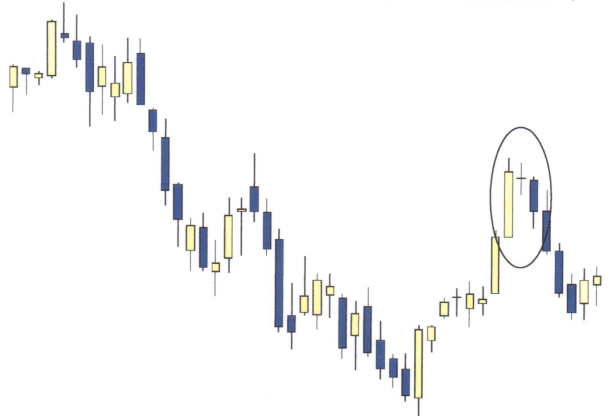

6c. The Harami Cross

Harami Yose Sen

Because the last candle is a Doji this pattem is much more significant than the standard Haramiline.

Shadows are excluded (except in the case of Tweezer which will be covered shortly).

Trading Strategy - Close current positions and look for an opportunity to stop and reverse where possible

Harami Cross Example

7 The Doji Star

Doji bike

Doji Star Example

8 The Separating Line

lki Chigai sen

The separating line is a powerful pattern and very rare.

The basis for this line starts in a trend. When (as in the example) the market is in

a trend and closes lower as expected. The

next opening creates a huge counter trend

gap and price action closes higher on the

aay

Separating Line Example

Separating Line Vs Meeting Line

A Separating Line tends to be more explosive at the beginning but tends to correct fairly quickly. Meeting

Lines tend to be weaker and the degree of penetration into the previous period move is important

9a Tasuki

The open of the real-body

which opens into the

previous days session I

haven't found many

ref erences to this pattem

but it does exist and you

should be aware of the

Tasuki as FX markets tend

to like this pattem.

Shadows are not taken into

consideration as we are

primarily concemed by the

suggested Harami - but

closes lower than the

previous session open.

This pattem is closely

related to the Tasuki Gap.

which is a three-line

reversal pattem.

9b Tasuki Gap

The Tasuki gap is a fonvn of star,

but instead of a spinning top or

Doji the gap is preceded by a

standard candle. The ambush line

is the third confirmation line. which

closes the window and forces the

change in the trend and

sentiment.

Reversal Patterns

Top Reversal

|

Bottom Reversal

|

Doji***

|

Dojo***

|

Shooting Star**

|

Hammer***

|

Hanging Man*

|

Star**

|

| Star** |

|

Bearish Engulfing Pattern***

|

Bullish Engulfing pattern***

|

Tasuki - Gap**

|

Tasuki - Gap**

|

Dark Cloud Cover**

|

Piercing line**

|

Harami Lined*

|

Harami line*

|

NB - The stars indicate the strength of the pattem

Three Day Reversals Patterns

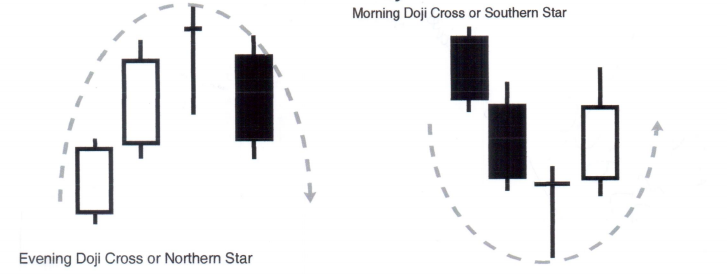

10a. The Evening Star

"Sankawa yoi no myojyo"

The market has to be trending

The second session is a smallstar that has gapped away from the place action.

The third session is always the opposite colour of session 1.

The related pattem (2d/c) would result in a bearish engulfing line/dark cloud cover so is extremely

negative

10b The Morning Star

"Sankawa ake no myojyo"

The market has to be trending

The second session is a small star that has gapped away from the price action.

The third session is always the opposite colour of session 1

The related pattem (2d/c) would result in a bullish engulfing line/piercing pattem, so is extremely

bullish.

10c The Doji Star

10d Sute Go Rain Drop

Sometimes known as the

abandoned baby and is

only distinguished by the

gap between the Doji star

and the last session close.

This pattem does not

require confirmation and

is very powerful.

Sute Go Rain Drop Example

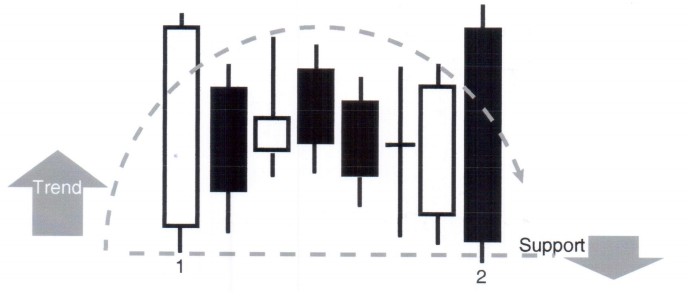

11 Upside Gap 2 Crows

This pattern is extremely rare

Session I is in a downtrend with a lower closing.

Session 2 is a Harami line of sorts but has the

lower close so the colour of the real-bodies are

the same in sessions I and 2.

Session 2 has a long lower shadow and in itself

is a hammer or Taku ri.

Session 3 is a meeting line sentiment is

beginning to change.

13 Three White Soldiers

13. Three White Soldiers

This pattem shows a bullish reversal.

Session 1, 2 and 3 are allbullish standard lines.

Session 1, 2 and 3 are allbullish standard lines.

The sessions allopen roughly in the middle of

the previous real-body and close higher as

bearish sentiment falters

No confirmation is required.

14. Advance Block

This pattern is potentially a bearish reversaland

certainly defines weakness in the current trend.

The three white candles in a sustained up trend

allopen within the previous session real-body.

The advance block is highlighted by the long

upper shadows leaning towards a shooting star.

Confirmation is required.

15 Three Black Crows

This pattern shows a bearish revenalpattern.

Three consecutive down candles are formed.

Each line opens within the previous days real body and closes on or near its lows, but lower

than previous session.

No confimlation is required.

16 The Harami age and Harami sage

17 The Tsutsumiage and Tsutsumi sage

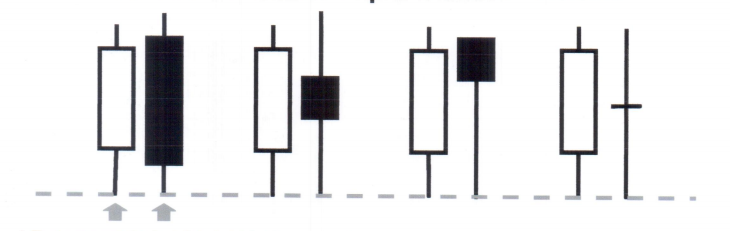

18 The Tweezers Top & Bottom -Kenuki

A Tweezers can be found at a market top or a bottom, and occur where the shadows of two consecutive

periods hit the same levelof support or resistance and failto close beyond that level.

A tweezers is best used as a confirmation to a reversal pattern i.e.. An engulfing pattem.

19 High Wave Warning - Takane nochiai

This usually occurs after a strong rally; the high wave is made up of a series of spinning tops, dojis and

umbrellas.

There are lots of clues to the direction of the breakout, but seek a confirmation line

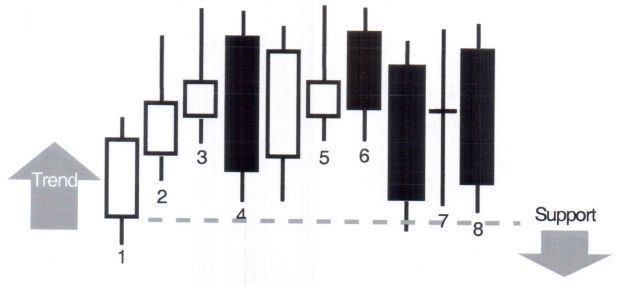

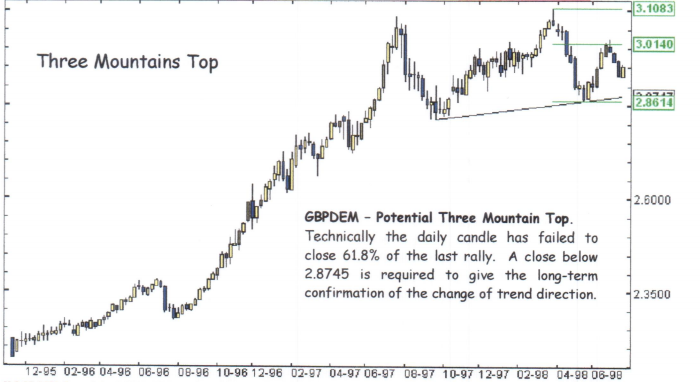

20 Tower Tops and Bottoms - Ohtenjyou

This pattem would equate to a double top and the break below the support following the second tower

and bearish engulfing pattem gives ample warning of the trend reversal.

Chapter 4: Candlestick Analysis

"The Sakata Constitution"

Sokyu Honma 1716 - 1803

The Number Three

Seiki Shimizu wrote in his book, 'the Japanese Chart of Charts', that the number three was very

important to the Japanese people, it was said to hold a divine power. The number four was considered to

be bad luck.

In Westem culture to a certain extent we have a similar belief, the Japanese expression Sandome no

Shojiki is unlike own saying of three times lucky

In modem day TechnicaIAnalysis there are many examples of our use of the number three

Three Trends, Three Gaps, Dow Theory has three phases of trends, Reversal Patterns such as Triple

Tops/Bottoms and Head and Shoulders patterns, three types of triangle, three types of continuation

pattem etc...

Sakatas Five Methods

Sanku

|

- |

Three Gaps

|

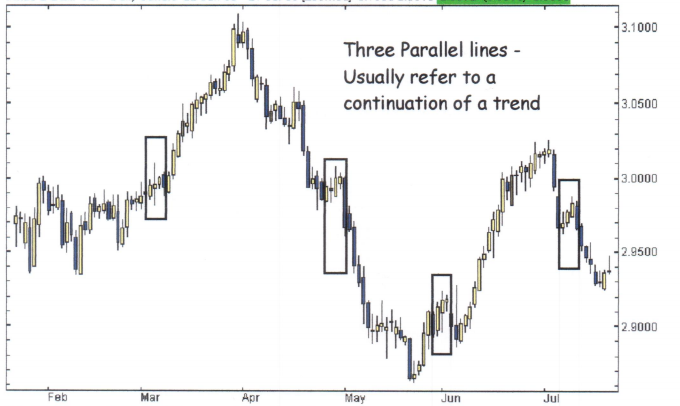

Sanpei

|

- |

Three Parallel Lines

|

Sanzan

|

- |

Three Mountains

|

Sansen

|

- |

Three Rivers

|

Sanpo

|

- |

Three methods

|

Sanku

Three gaps, this can be a common occurrence in the Commodities and Future markets.

The three common forms of gapping play are the Breakaway gap, Runaway gap and the exhaustion gap.

Sanku is more precise as it refers to a series of gaps between three consecutive candle lines.

Sanku can be made up of three white soldiers or three crows, but always imply weakness present in the

prevailing trends.

Sanku

Sanpei

Sansen

Sanzen

Sanpo - Money Management

Three methods

- When to buy o. Sell

- When to take profit

- When to cut a position

Set Your Rules

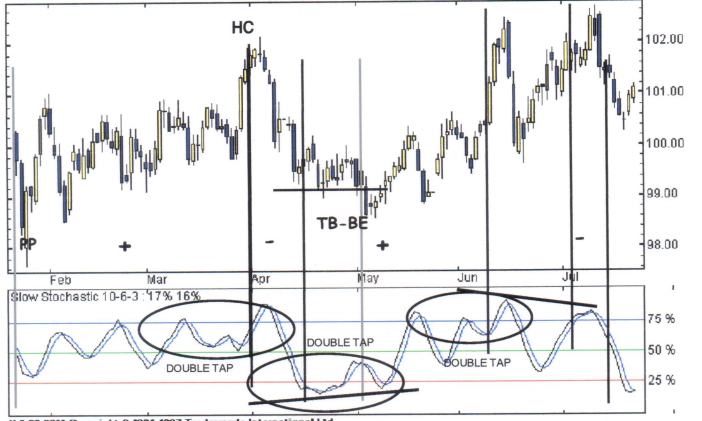

Oscillators - I have always looked at two oscillators - The Slow Stochastic and the Relative Strength Index.

lalways use the same parameters for the indicators because Idon't believe in optimisation of an indicator.

Instead. llean towardsstatisticalanalysis looking solely for consistency over time. It is essentialthat you

learn to recognise the strengths and weaknesses of the indicators that you are using

The Parameters that fuse are Slow Stochastic 10-6-3, and RSlof IO

What do look for?

- A reversal pattem in an extreme zone.

- Indicator and Price divergence for the longer term trend reversal.

- The Double Tap.

What is a Double Tap?

A Double tap is a failure swing - but observations and experience have shown that the swing must remain

above the 50% line, and where the second peak is higher. The exception to the second peak rule is where

there is obvious price and indicator divergence.

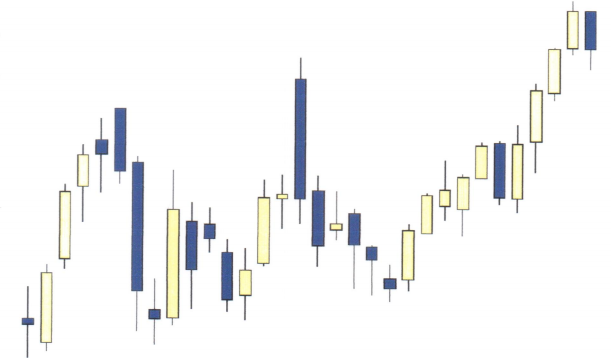

Candlesticks and Oscillators

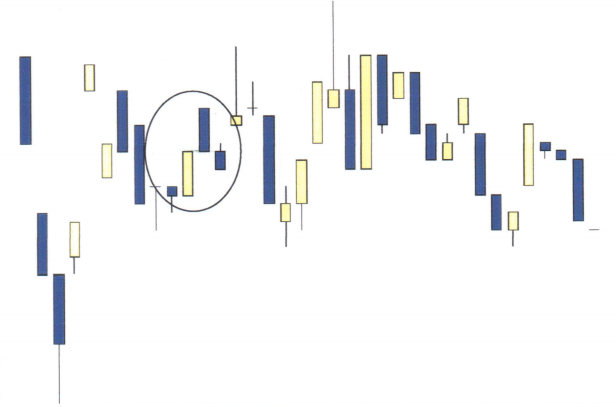

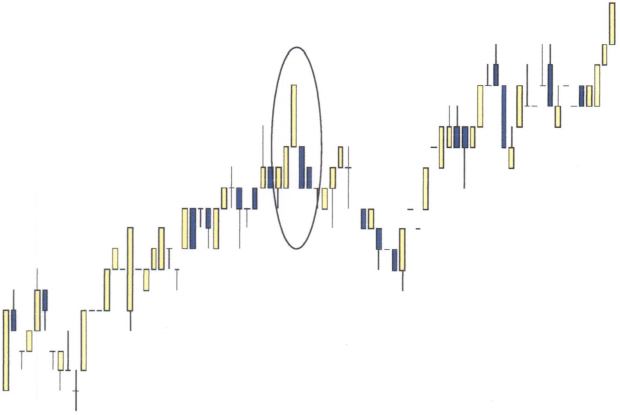

Trading Example

In the last example we can observe the Slow Stochastic oscillator crossing in the oversold zone (below

25%). A lot of people would now consider that from this level we should get a reaction

The Candlesticks, however, show a thrusting pattern - which falls short of the definition of a Piecing line

revensal because of insufficient penetration into the previous session's real-body. (Irrikubi or in

neckline)

The following three sessions are a stalling pattem (Sake zumari) with the three gaps (Sanpo). This

indicates a possible bearish reversal contrary to the impression left by the Slow Stochastic, which has

crossed in oversold zone. The only time I am a buyer is when a proper reversal signal is observed or when

there is clear price Divergence or a Double Tap.